Why are long-term clients so profitable? Because it costs four to six times less to retain an old client than to acquire a new one. But not only do new customers cost more, they also tend to be less valuable. Their spending is often dwarfed by their customer acquisition costs leading businesses to not see dividends until long after the initial sale. This is why obtaining and keeping the right type of customers is paramount for any business. Ideal customers will remain loyal in the long run and will give you consistent sales. They are not lured by short-lived promotions or price discounts, they rather see the value in the product or service you provide. They buy more, pay more, cost less to service, refer other clients, and create fewer bad debts.

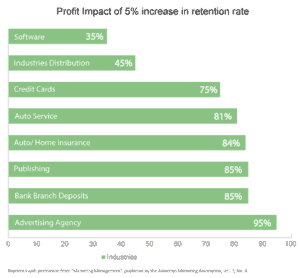

Last year, Apple’s retention rate was at the colossal percentage of 92, meaning that 92 percent of iPhone owners were very likely to purchase a new phone model in the next 12 months. While your business may not achieve the retention rate this high, even a few percentage increase will make a significant change to your profit. Studies show that a mere five percent increase in retention rate can boost corporate profits anywhere from 35 percent in the software industry to a whopping 95 percent for advertising agencies ( see Table 1). In short, these are customers that look beyond your prices and are the bedrock of a healthy business.

Table 1

Satisfied Customer Aren’t Automatically Loyal

According to an article in the Harvard Business Review, satisfied customers do not necessarily translate into loyal customers. The article outlined that many customers who defect are actually ‘satisfied’ or ‘very satisfied’ with their former supplier.

As a business, you must have a strong retention strategy in place to convert these satisfied customers into loyal ones. Analyzing how you can deliver superior and lasting value can help achieve this end. Once you pinpoint what makes a loyal customer, you can develop a company-wide strategy emphasizing these traits. Then you can focus on not only retaining customers but also attracting new customers with the same traits.

4 Strategies for Customer Retention

The best measure of customer loyalty is repeat business. We will outline four strategies we use to create effective retention strategies that will help your business grow.

1. Conduct Defection Analysis

As airlines use black boxes to determine what went wrong, you must analyze, in detail, why customers leave. Failure analysis is an essential tool to improve your overall operations.

When one of Pricing Solution’s clients, a bank, lost one major international customer to a competitor, there was much disagreement in the ranks over the cause. “To get to the root cause of the defection, we met with the bank’s former client,” says Paul Hunt, President of Pricing Solutions. “During the interview, we learned many things which had a significant impact on the buying decision, of which our client was unaware.”

The customer indicated that they wanted a more senior operations person involved in the negotiations, yet our client perceived that the person they had involved was senior enough. Meanwhile, the competition sent in their most senior operations people, creating a substantial imbalance and playing a critical role in the difference between retaining and losing the account.

Discern the Cause

Part of defection analysis is determining what customer retention strategies mean for each organization and industry. On the surface, it may seem simple to identify why customers have defected, however, this is not always the case. For this bank, it was a matter of involving more senior members in the client facing duties. For other industries, it could be something much harder to parse.

2. Analyze Client Behavior

In order to develop a loyal customer base, you should understand your customers’ behavior. By mapping out the buying process by client type and identifying key points in purchasing decisions, you can make it easier for customers to be loyal.

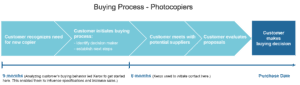

This exercise paid off handsomely for Xerox Corporation when they conducted a study of its selling cycle (see Table 2). Previously, the company communicated with its customers about six months prior to when they would normally buy next. However, their behavior analysis discovered surprisingly that customers initiated the buying process about nine months before making the purchase. Therefore, in order to influence the buying decision, Xerox realized it had to communicate with its customers nine months in advance, rather than six. Once the buying process has been identified, your company must develop a communications program with customers that respond to those key decision points.

Table 2

3. Manage Complaints

Customers who voice a complaint are twice as likely to repurchase if the complaint is resolved to their satisfaction. Therefore, view a complaint, not as a problem, but as an opportunity to gain a loyal customer.

The conversion of a complaint into loyalty first starts with an open and easily accessible channel for clients to lodge complaints. Toy manufacturer Fisher-Price, for example, provides a toll-free number with all its products. If a customer calls to complain about a particular product, the company replaces it almost immediately, free of charge. Now that’s service!

Furthermore, consider establishing a follow-up procedure to ensure the complaints get resolved. Pizza behemoth, Pizza Hut, follows up on all their complaints with a phone call. They immediately rectify the problem and call the customer again to confirm that the company has met the customer’s expectations. This effort has a huge payoff. Pizza Hut estimates that the average customers spend about $14,000 over their lifetime on pizza. These customers are well worth protecting.

4. Categorize Customer Loyalty

The fourth strategy to customer retention is the process of “zoning” customer loyalty. This means using predictive modeling to identify how loyal a client is. “Typically, you categorize each customer as a level one, two or three, with one being the most loyal and three the least loyal,” explains Hunt. “You develop criteria to determine whether or not a customer is loyal, and then zone that customer accordingly.

But changes in a client’s circumstances can directly impact whether you will retain them as a customer. For example, if a buyer with whom your company has a long-standing relationship is transfer, that customer would drop a level because of uncertainty over the new buyer. Or perhaps the customer is experiencing financial difficulties. That would also cause them to drop a level because the funds for purchasing your product may no longer be available. Having identified this, prompt corrective actions can be taken.”

Ingraining Customer Retention

To conclude, customer retention strategies cannot be add-ons to existing business models, rather, it must be part of the company’s DNA. Everyone from salesmen to top executives must be on the same page for creating a loyal customer base. In order to retain this client base, you must consistently deliver exceptional value and understand why customers defect. We understand that it may be challenging action to execute, but our experience shows that it is the best way to achieve your business full profit potential.