You have developed a new innovative product or service that promise to add significant value to your customers. But do you know how to price this new offering? Most importantly, how do you know you’re setting the optimum price to maximize customer adoption and drive the most value to your firm’s bottom line?

The Thorny Task of Pricing New Innovation

There are major challenges to pricing new innovations, particularly those that promise to transform your market.

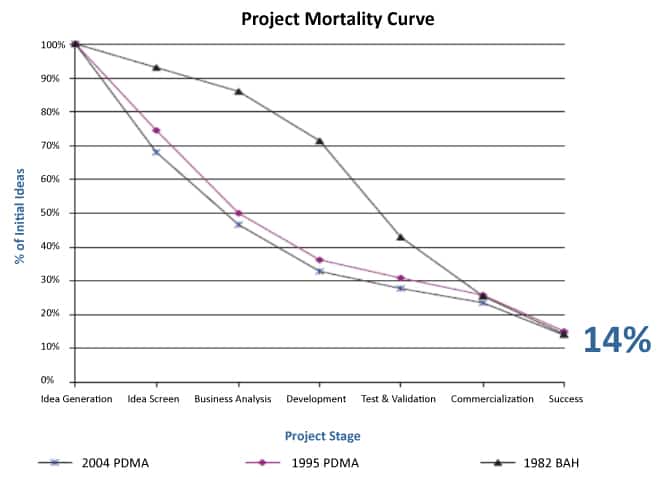

Based on past research, the chart below shows the success trajectory of new product ideas that succeed. This is known as a “project mortality curve”. The three lines illustrate a decreasing trend in success rates from 1982 to 2004. As you can see, by the time a new product gets to market, it only has a 14% chance of success. Commercialization failures are responsible for over 10% of the failure rate, but 70% is caused by failures much earlier in the innovation process.

The Top 5 Reasons New Innovation Launches Crash

Let’s look at the most common causes for commercial failures of new innovative products. This list was derived from thousands of product launches in hundreds of industries.

#1 – Lack of Market Research

This materializes in three ways:

- Deep market research isn’t done from the beginning of the product design process. This causes a lack of understanding about the features customers will value and actually pay for. The pressure to launch is so strong nearing the product launch date that deep value research (and any resulting feature changes) are often not possible.

- Generic research techniques like simple surveys and competitor benchmarking — or worse, speculative internal brainstorming — are used to set pricing. This results in a weak positioning, non-optimal choice of features and poor pricing strategy.

- “Head in the Clouds” and “Our Market Won’t Pay More Than X” Pricing. Often an organization’s expectation of the price customers are willing to pay is above what the market will bear. Management overestimates potential revenue, then the product’s features and cost structure are designed around an unattainable price. The company discovers this too late in the launch cycle to correct course or learns it post-launch when the market responds poorly. “Head in the clouds” pricing turn into heads rolling. Rampant underpricing is an equal problem that leaves tremendous value on the table. We typically see this in industries like equipment and technology manufacturers, where cost-plus pricing is common. Preconceived notions of what the market will pay often do not apply when it comes to new product innovations.

#2 – Budget Consumed by Product Development

When the majority of the budget is spent on product development, little is left over for market research, optimization studies, segmentation, message development, sales training, etc. The company ends up in a weak “build it and hope they will come” pricing position that competitors quickly take advantage of.

#3 – Imprecise Targeting

A proper targeting analysis includes deep research and engagement with your market that goes beyond basic segmentation. Due to the very nature of innovation, traditional customer tiering and segmentation models may not apply. In our pricing engagements, we often uncover entirely new categories of customers to target and price differently.

#4 – Key Differentiators and Advantages Not Articulated Clearly

Failing to incorporate pricing and market research from the beginning of the product development process leads to poorly differentiated offerings. Sales and Marketing are left to launch the offering into the market without adequate value development, case studies and messaging.

#5 – Large Unexpected Cost for Customer Education

It is common for customers to not understand how new innovations can be used. Customers don’t automatically know how to take advantage of innovation, often requiring a substantial up-front investment in education. Proper market research early in the process uncovers how much early adopters need to be educated. Getting this wrong can delay revenue realization by months or even years.

An Example of a Major New Innovation Pricing Mistake – Google Glass

Google Glass was launched to early adopters in April 2013, priced at a costly $1500 a pair.

After Glass was released to the public in May 2014, it had a poor market response. The high price point, coupled with its bulky design, privacy, safety and device ownership concerns caused Google to stop producing Glass for consumers in January 2015.

Image credit: YouTube

But Google corrected course. In July 2017, Google announced the release of Glass Enterprise Edition. The product has since gained significant traction at higher price points in manufacturing, logistics, agriculture, and healthcare. Firms such as GE, Volkswagen, AGCO, Samsung, and Dignity Health have adopted them to increase collaboration, productivity, and quality.

For example, AGCO achieved a 30% reduction in inspection time, a 25% reduction in production time on low volume assemblies, and a 50% decrease in learning time for new hires. Wiring technicians assembling GE wind turbines experienced a 34% increase in productivity and meaningful quality improvements using Glass. Samsung’s global parts warehouse in the Netherlands experienced an increase of 22% in parts picking speed.

Had Google targeted the enterprise market from day 1 and priced Glass correctly, the company would have recouped development costs faster, avoided embarrassing publicity and grown it’s revenues earlier.

What Are Your Options for Pricing New Innovations?

There are four major approaches your firm can take to price new innovations. These are not mutually exclusive.

Option 1: Hire a Pricing Expert

Hiring a pricing expert to assist early on in your innovation process puts the right structure in place to avoid not only pricing failures but to increase the market viability of your new product or service. This means allowing an outside pricing expert into the process to help fine tune the elements that drive value for your innovation. Not all customers will perceive or realize the value your team is trying to create. An innovation pricing expert will help define those customer segments, and the features they should receive, then determine the right price for each segment to maximize the product’s success and overall value to the firm.

Option 2: Internal Pricing Team

Many companies have internal teams responsible for pricing new products or services. Typically, these teams have solid industry experience and a combination of product knowledge, marketing, research and financial / analytics skills.

An internal pricing team typically goes through some sort of framework involving intelligence gathering (often with the assistance of an internal or third-party market research group), building a financial model, mapping features vs. benefits vs. customer value, sampling customer perspectives and aggregating all this information into a predictive pricing model.

The challenges internal pricing teams face are many. Do they have deep data science capabilities or the quantitative platform to do it correctly? Are the customer outreach and sampling done effectively in a statistically valid manner? Is enough data available in a usable format? Are key resources like the Marketing team available? Is the team biased by myopic thinking, political forces or traditional industry pricing approaches? Are they aware and capable of adopting successful pricing strategies from other industries? Is there an experienced advisor to play Devil’s Advocate and fill in missing pieces of the puzzle? Is the pricing team involved at the inception of the product design, or only at the start of the go-to-market phase?

Internal pricing teams often do an excellent job with limited resources. But, we’ve found that the challenges they face often lead to sub-optimal pricing, thereby leaving substantial value on the table.

Option 3: Cost-Plus-Margin Approach

A traditional cost-plus approach is common. The team responsible for pricing adds up the cost of development, cost of sales, and any overhead allocated, determines the amortization method to use, and calculates a market price. The projected price is then tweaked to fit in among the competition. This approach is easy to understand (though not necessarily simple) and tends to be driven by Finance.

The problem with cost-plus pricing is it does not reflect the potential value the customer will pay for innovation. There is little understanding of which customers are willing to pay more or less.

Furthermore, projected margins tend to fall apart when the product is taken to market. Sales go out and discount the product. Hidden shipping and return costs appear. The expected 20% margin shrinks to 14%.

Cost should be perceived as a floor on price. However, to drive value, you need to understand and price your product or service according to who will buy at what price point(s). This is inherently an external-facing view versus cost-plus which is internal-facing.

Option 4: Competitive Benchmarking

In this case, you identify equivalent and substitute products from competing vendors, then price your product at parity, discount or premium. This typically involves scanning the competitor landscape and deciding intuitively how your new product or service fits into it.

The problem with benchmarking is it assumes that customer perception is irrelevant or has already been taken into account by your competitors. For highly commoditized products this may be the case, but even there the success of branding proves that customer perception and market positioning can be used to drive value through pricing. Benchmarking is less viable as an effective pricing tool for new innovations. Benchmarks are useful parameters, but it’s critical to incorporate the customer’s perspective to drive the pricing model.

Key Value-Based Success Factors

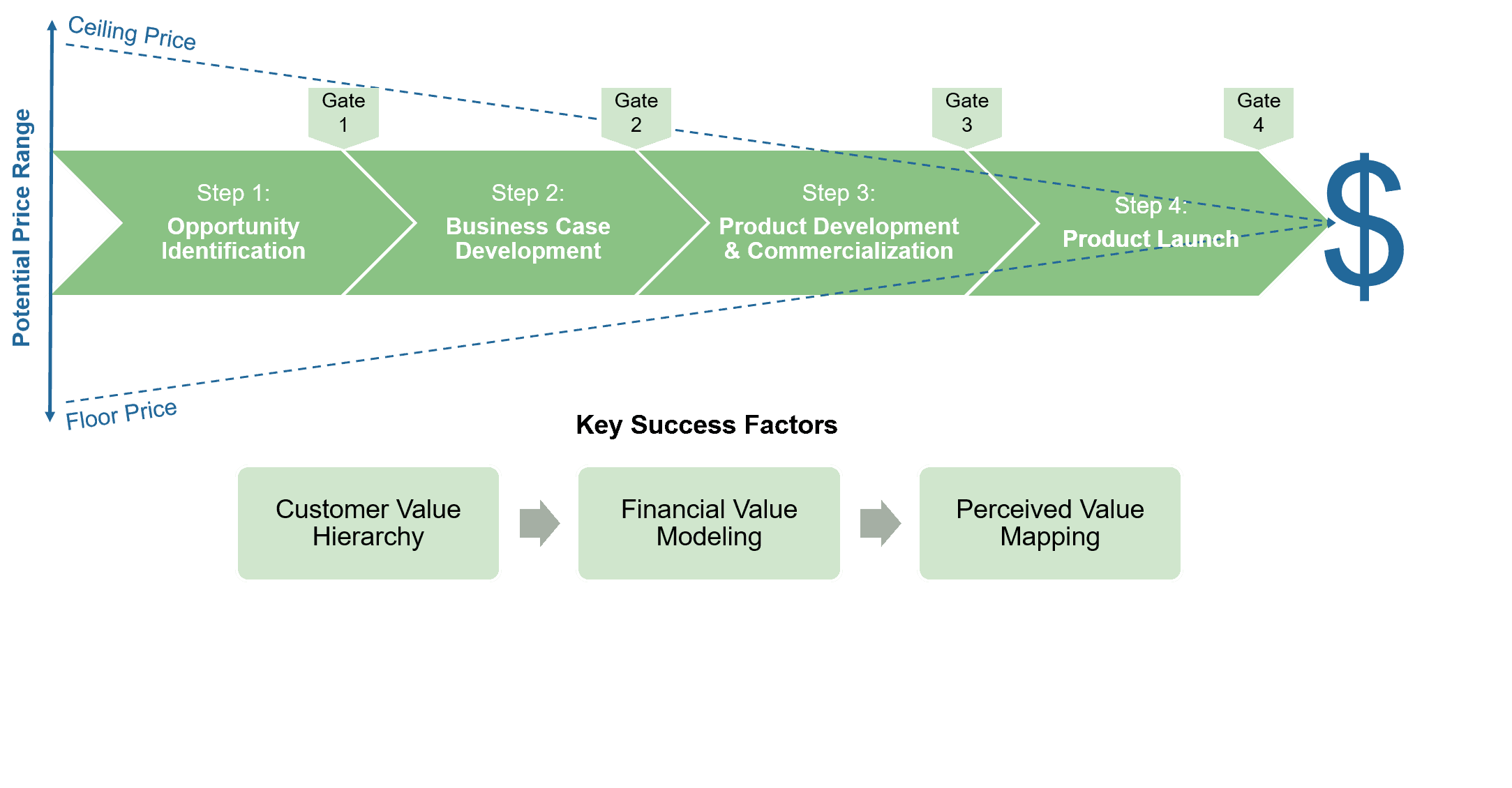

The chart below illustrates the process we execute for our pricing clients. This is a comprehensive approach that uncovers key customer value and price points through rigorous research and analysis. It fully engages both qualitative and quantitative tools to determine the optimum pricing for each customer segment and feature set of your offering.

Value Mapping

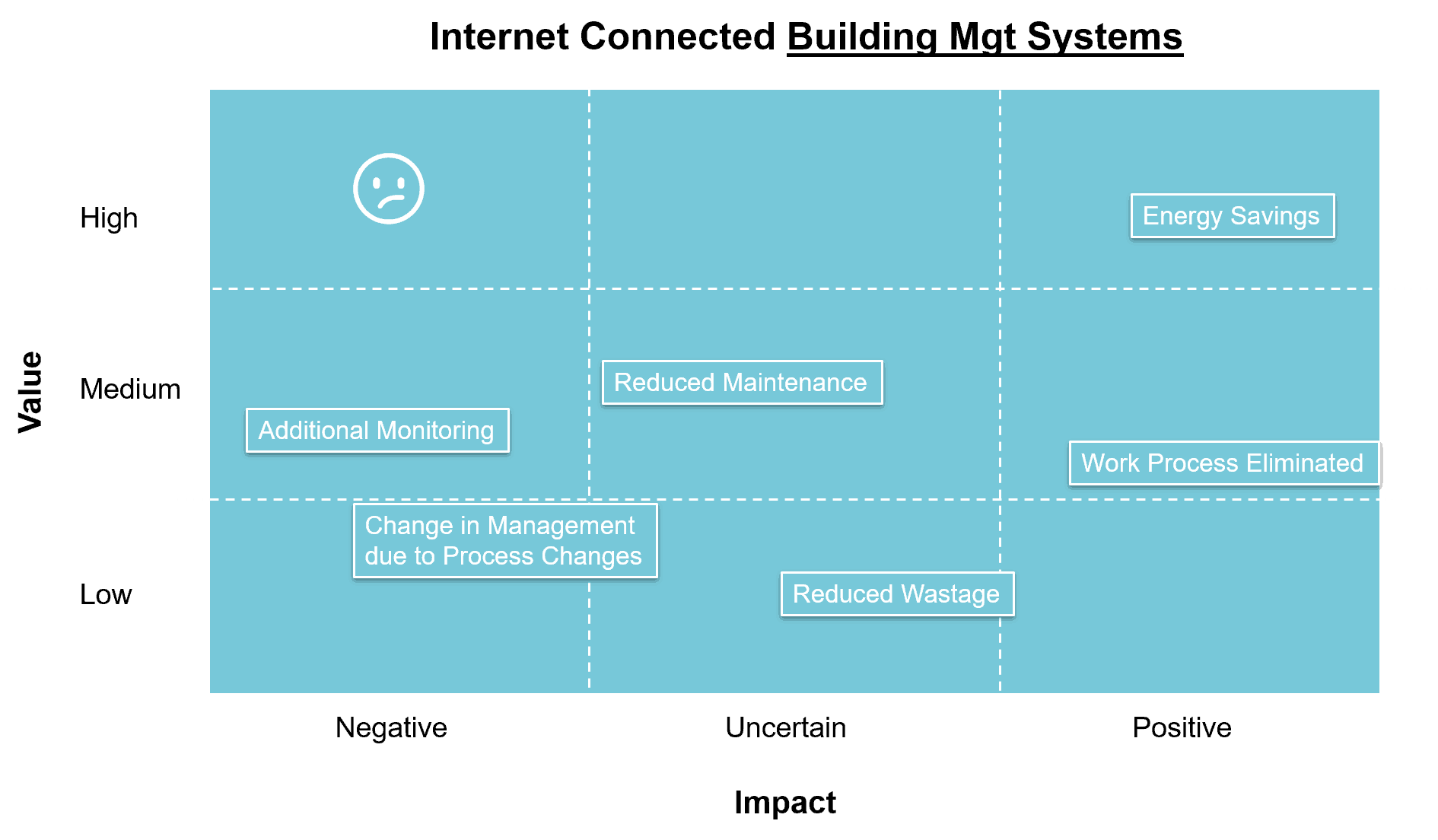

Below is an example of how we identify and make sense of the customer’s perceived value across different product/service features. This requires surveying existing and potential customers using multiple statistically significant methods. The chart uncovers concentrations of valued vs. non-valued items.

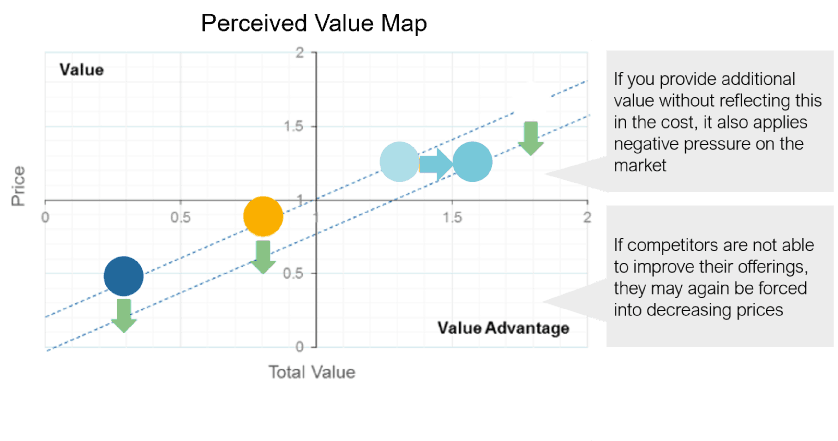

Later in the process we again analyze perceived customer value, but this time in the context of how the market will react to different prices.

This process is highly iterative and requires integrating multiple analyses and data points to arrive at your “optimal” price. This applies both to the individual product launch and the value generated for your shareholders.

Read more on how to figure out the value of your innovative product.

“Design to Price” is Critical to Innovation Success

By incorporating deep market research, value discovery and pricing early in the life cycle — ideally as early as the early design/prototyping stage — companies stand to reap huge benefits by increasing their hit rate and ROI on new innovations.

Companies invest billions in innovation, product/service development, and commercialization. Price is a cumulation of all that investment. It’s too significant to leave pricing to the end of the process. By delaying pricing until late in the process creates substantial real risks that you will mis-price your new offering, potentially destabilize the market (competitors respond with a price war) and fail to capture the expected ROI. To learn how to optimize the pricing of your company’s new product or service innovations, contact us today for a consultation.