In previous posts, we’ve discussed the merits of performing price optimization to maximize long-term profit through looking at the Customer Lifetime Value. Ultimately pricing managers, who are trying to optimize both everyday prices and promotions, will begin to look into segmentation. More effective segmentation, and a pricing structure that responds to the specific needs of particular segments, provides an opportunity to improve both growth and profit in the long-term.

Segmentation for Long-Term Growth

In recent years, companies have tried to improve pricing management through the adoption of initiatives such as implementing price increase or more effective management of promotions/discounts. As mentioned above, the real opportunity is through segmenting customers based on their willingness to pay and introducing a revised pricing structure that caters to the needs and constraints of each.

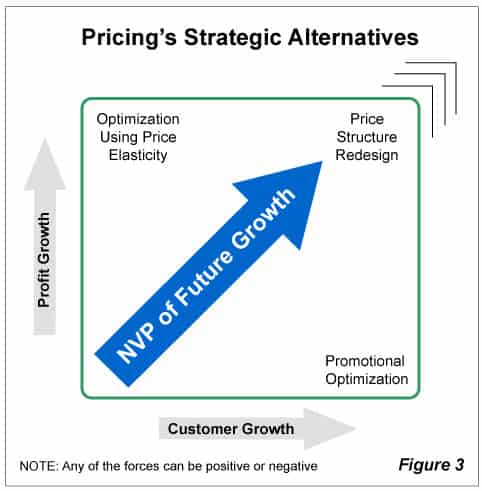

Figure 3 shows how various tactics might result in profit or customer growth over the short-term. A move that takes a company up the vertical axis (such as a price increase) can increase profits but does not improve value and therefore might hurt the long-term future of the business. Similarly, a promotion developed to entice new customers (e.g. a temporary price reduction) might train new customers to hold out till the next sale if there isn’t a strong link between your promotion and the value of the brand. In both cases, the tactics are short-sighted and create an unprofitable business model, unlike customer segmentation structure which continues to capture value over time.

If we consider a recent financial services client of ours, they had wanted to implement a “one-rate-fits-all” price increase. An analysis of their cost structure revealed that high-balance customers would be extremely expensive to replace if they were to leave due to the price increase. The bank quickly restructured their offerings to provide a premium savings rate to customers who required more account management reducing the required acquisition costs of high-value customers and allowing the business to grow assets. At the same time, by retaining more customers, the bank reduced acquisition costs and improved its bottom line.

Growth and gross profits need to increase symbiotically.

Price Structure Based on Customer’s Willingness to Pay

Not all customers are the same, and neither are the prices that they are willing to pay. In order to start the process of segmentation, start by dividing customers by their pricing needs and constraints. Then build prices that cater to those individual groups.

You could be losing out on revenue by not properly segmenting your customer base.

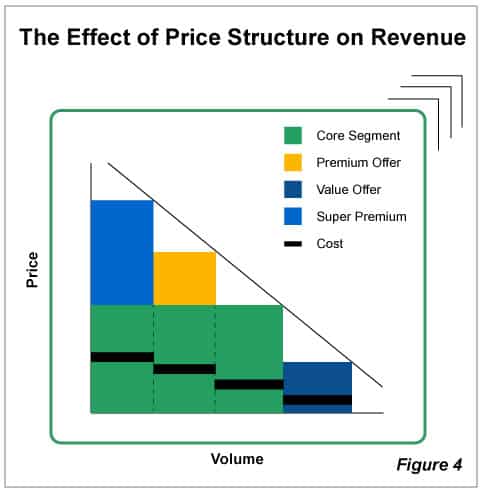

Figure 4 shows a simplified demand curve with various willingness to pay segments. Many firms offer something similar to the dark blue rectangle, a single offering at a relatively affordable price. We can see that the white triangles (above and to the right of the dark blue) represent missed revenue because some customers were willing to pay more (white above dark blue) and other customers felt the offering was too expensive (white triangle to the right).

The green, light blue and yellow represents an alternative “segmented” model with new revenue opportunities created through segmentation and effective price fences. In this new model, the green represents a core offering and the dark blue becomes a value offering, something with the bare essentials. A company can then layer in features to create premium and super premium offers based on what features different customers are willing to pay for.

The black bars represent the corresponding cost levels and provide a rough comparison of the additional costs of premium and super premium offerings. A pricing manager should structure offers so that cost to serve decreases with decreasing willingness to pay – but that’s a topic for another article.

Achieve Long-Term Growth

Through this new structure, a company can capture additional revenue through reducing lost sales (the white triangles we mentioned earlier). In the long-term continued pricing research provides updated consumer insights which can help a firm create features and offerings to maintain various price levels. This feedback loop is the making of an optimized pricing process that keeps the customer/consumer at the center and allows a firm to stay agile as markets change.

For more information on Pricing Solutions strategy development, research or past experience consulting with firms on pricing please contact us.