“Where can we improve?” is a question that is leading the charge for change within the newspaper industry. Modular advertising is often a topic of such discussions, despite differences in opinions about the benefits and risks associated with this pricing practice. The term “modular” itself indicates that ad space is offered based on fixed unit sizes (modules), as opposed to providing endless flexibility for advertisers to choose any ad size using line‐rate pricing strategies. So why would a newspaper want to limit an advertiser’s options for ad sizes, you might ask?

Benefits of Modular Pricing:

- Provides an Alternative Pricing Strategy to Line Rates: Line‐rate pricing strategies often fall into a yearly increase (e.g. 4‐5%). This contributes to the longer‐term “catch‐22” as advertisers buy smaller, lesseffective ad sizes over time. Modular pricing, on the other hand, allows each module unit to be priced as a separate product offering. Not all modules need to receive the same net line price point; in this case, a new pricing strategy is being used, since different modules can be priced to drive different purchasing behaviors

- Encourages Desired Ad Sizes and Discourages Unwanted Ad Sizes: “Page busters” can often take premium ad locations, especially within Section “A.” That means a lost revenue opportunity if that particular location could have housed a full‐page advertisement instead. Modular layouts offer an opportunity to charge a premium for or omit such unwanted sizes.

- Lowers Cost Structure and/or Improves Efficiency: Modular layouts can help simplify both the layout and selling process, reducing costs and making more efficient use of internal resources.

- Potential to Reduce Pre-Priced Tickets / Non-Standard Rates (NSR): Sales reps can often override invoice amounts by rounding down net totals resulting from line‐rate calculations (e.g., NSR an ad to $4,000, as opposed to $4,244.26 calculated using line rates). NSR ads can undermine business analytics because they often hide the impact of value‐added offerings that include color, page guarantees, Section A premiums, etc. Because modular units can be priced at specific psychological price points, sales reps are less inclined to override the module pricing, which reduces the number of NSR ads.

- Addresses the Issue That All Ads Are Not Created Equal: Advertisers realize different benefits for ads of different sizes. Line rates infer that value is a linear function of space. Research has shown that this is not the case.

- Simplifies and Improves the Layout / Appearance: Readership surveys have indicated that readers prefer a cleaner, clutter‐free layout. Modular advertising can enhance the overall appearance of the newspaper, thus improving the experience for the reader.

- Enhances Effectiveness of Advertisments: Modular units provide a simplified stacking approach for advertisements. Non‐modular ad stacking, by contrast, often results in a cluttered appearance that potentially devalues an advertiser’s content.

- Modules Can be Priced to Encourage Size Upgrades: Using a non‐linear relationship between the size of the ad and the price, newspapers can create financial incentives for advertisers to behave in ways that will make their ads more effective and at the same time make the paper easier to read. For example charging a premium for page or half page dominant ads will discourage their usage.

- Using Modules Can Provide an Opportunity to More Fully Capture Color Premiums: Many newspapers have made significant investments in their color facilities as they continually strive to improve their value‐add with advertisers. Unfortunately, in many cases, color is used as a negotiation tool, and premiums can be discounted or over‐ridden entirely. Using color modules that are priced separately from their B&W module counterparts can improve profitability by more fully capturing the benefits of this value‐add.

Many newspapers are already using modular advertising, particularly within the European market, which is gradually becoming standardized with smaller‐size formats (i.e., Berliner, tabloid/compact formats). However, even though the concept of modular pricing has been around for a while, many newspapers still have a lukewarm response to it. Can modular advertising truly increase revenue? Would advertisers scoff at the lack of flexibility to determine their own ad sizes? There are definitely conflicting viewpoints about the benefits of this practice.

When is Switching to Modular Advertising Most Effective

1. When there is a major change to the format of the paper

Many European papers have downsized the page size to reduce print costs and satisfy readership preferences; a few North American newspapers have followed suit. But with a reduction in paper size comes a reduction in total lineage per page—a recipe for lost revenue unless line rates are increased accordingly. Line‐rate increases can be a difficult conversation with advertisers and agencies. As many European papers have discovered, modular advertising can help avoid these obstacles by simplifying the offering. Regardless of physical page dimensions, modules that are sold as a percentage of page coverage (e.g., 1/8 page, ¼ page) will show no change in pricing if newspaper format changes.

2. When Re-aligning line rates with changes to column widths and heights

With an aging readership, many newspapers are considering moving to fewer columns, as well as the possibility of increasing font sizes. Similar to downsizing page dimensions, column reductions and fewer lines per column also result in an overall drop in lineage per page. Line rates would need to be increased to salvage revenue, which, again, can be a difficult conversation with advertisers. While in this case, the physical ad dimensions and net price for advertisers might remain the same, there is still the perception that line rates are increasing. Modular pricing helps remove the negative impression that might otherwise have been associated with increases to these line rates.

3. When there are several competitors adopting modular advertising

If more newspapers transition to standard modular sizes, advertisers will produce ad materials to match standard modules. Differing web widths is one impediment. Selling ads based on value not size is the other. Modular advertising is common in the European market. If, however, your paper is the lone wolf, modular pricing can present some additional challenges. Advertisers will require an introduction to the new approach, and may initially see it as more complex compared with today’s line‐rate structures.

The biggest challenge we see is that given different press sizes, even industry standard modules will not mean industry standard sizes. Advertisers complain that they still need to adjust ad copy to fit the modules of different papers. We believe this is an area where The Industry Association could help.

Whether or not your organization should transition to modular advertising will ultimately depend on your corporate strategy, long‐term objectives, and an assessment of the risks and benefits (i.e., investment considerations for billing and accounting systems changes). Modular advertising might not be for everyone, but those who do decide to implement it should take a rigorous analytical approach to ensure that module sizes are carefully selected and well‐priced, and that they provide an opportunity for growth while minimizing financial risks.

Building the Modular Pricing Roadmap

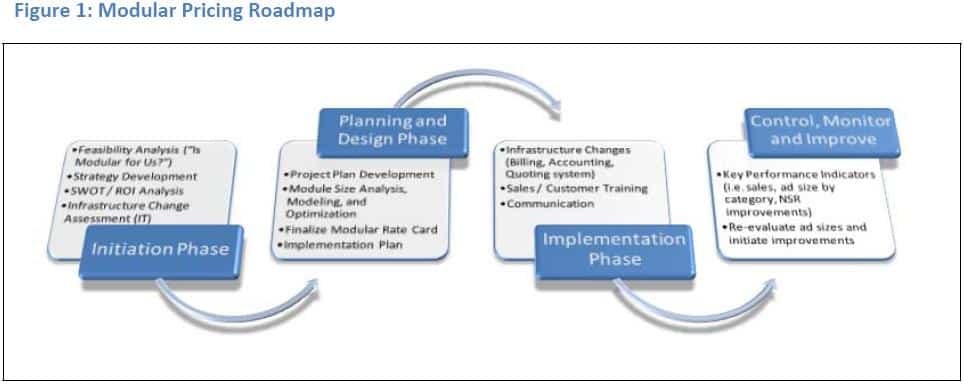

Building a roadmap is an excellent starting point to ensure the path to implementation is free of both roadblocks and bottlenecks. The process begins with a vision, defining goals and objectives, and building short‐ and long‐term timelines. It is critical at this point to fully engage management and category manager teams, for two reasons: they can help bring an understanding to the modeling and analysis; and they need to buy into the overall process, since they will ultimately be selling the modular rate cards. The higher the participation of the advertising managers, the greater the likelihood of a successful implementation.

The Initiation phase is crucial, as it helps determine the feasibility of implementing modular design, based on estimated financial payback and strategic analysis. In addition to the strategic considerations posed above it is important to understand: How much will it cost to alter the billing, accounting, and quoting systems? Will cost savings and potential revenue growth using modular pricing provide ample return on investment (ROI)? The Planning and Design phase integrates managerial feedback, as well as modular modeling, to optimize profitability, estimate and minimize risk, and develop the desired modular rate card. The Implementation phase involves changes to various systems (billing, accounting, and sales quoting), as well as updates of marketing materials, communications (sales message and plan for overcoming objections), and sales training. This is also a key stage to communicate both internally and externally about the transition to modular rate cards. The final phase is Control, Monitor and Improve. There are always hiccups, and, as many modular‐based newspapers discovered, it was necessary to make changes to some segments in order to strive for improvement and maintain healthy advertiser relationships.

What Happens to Revenue and Profitability

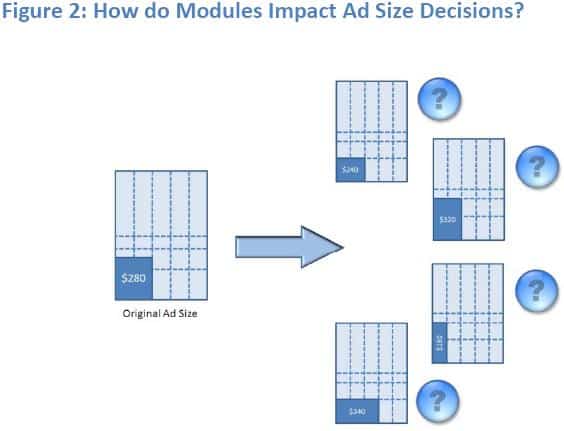

Throughout the Planning and Design phase, it is important to understand the current and historical purchasing behaviors of advertisers in order to develop a sound forecast model that will analyze possible behavior changes with modular pricing (Figure 2). During this process, newspapers will need to address key questions within the model, including:

- How are customers expected to migrate from endlessly flexible ad sizes to fixed module sizes?

- How will module price points influence purchasing decisions from one module to the next?

- What is the impact of limiting the number of available modules?

- What if the number of available modules varies by section or by page locations (e.g., only a half or full page is available for Page A3)?

- How do module sizes impact categories (e.g., automotive, movie distributors, small retailers)?

- How will modular pricing impact your anchor tenants (i.e., large contract accounts)?

- What is the best approach to assessing best, expected, and worst‐case scenarios?

- Which accounts will incur price increases, and which will benefit from price decreases (Winner & Loser Analysis)?

It is essential to involve the management team as well as the category managers in the Planning and Design phase. Besides helping to answer the above key questions, category managers will provide much needed feedback and voice additional concerns that might otherwise have been overlooked during the module rate development.

From our modeling experience, we have found it highly useful to model best, expected, and worst-case scenarios. As well, top-line considerations identified during the Initiation phase can help steer your modeling scenarios. For example: Are you looking to break even with modular pricing? Drive additional profit growth? Increase ad frequency? In these cases, a pricing strategy is directly related to your business and category strategies.