By Kirk Jackisch, Global President of Pricing Solutions

Subscription pricing – it’s trending across industries, slowly taking over legacy pricing models of the past 50 years. Before we explore that mindset, let’s look at what’s driving the trend.

Why Subscription Pricing Models are Popular?

Today, many customers, even in the B2B sector, are seeing the advantages of low upfront costs. As PC World explains, “consumers are today less willing to pay large amounts for products or services upfront. Instead, we now prefer to use a car or bike for a day, rather than commit to the full cost of owning one forever…all for low monthly fees.” Referred to as the subscription economy, it’s a booming way to do business.

The fundamental driving force behind the subscription economy is the preference to try before committing with use-as-you-need services. One of the reasons that new cars purchased by millennials fell almost 50 percent between 2007 and 2011, according to Business Insider, is the rise of ride-sharing businesses like Uber and Lyft. Millennials aged 18 – 25 are more likely to have participated in renting rather than buying a car.

While ridesharing has shaken the auto industry revenue model, successful subscription pricing models are not industry specific or limited to B2C. Although it may be more widely known in the B2C market, subscription pricing is being adopted by B2B as well. In fact, all goods sold off the shelf that become customers’ acquisition are potential targets for disruption by subscription pricing models.

The question is whether it’s a right pricing model for a specific business and that really comes down to two factors:

- The company’s mindset

- The customer’s behavior.

Company Mindset – Short or Long-Term Gain?

With the most common purchase/pricing models, customers pay an upfront fee and then pay extra for maintenance, support, and upgrades as needed. But, with subscription pricing, customers get access to the product/service plus these features for one single, annual expense which is less than the perpetual licensing fee (i.e. outright purchase). In SaaS (Software-As-A-Service) pricing, a type of subscription pricing specific to the software industry, an annual fee is usually 40 – 60 percent less. That also means that software companies that are switching from a perpetual license model to a SaaS pricing model are expected to make less up front.

Let’s do the math. Say that a SaaS solution has a single annual fee that’s 40 percent of the perpetual licensing cost (which is $100). With this SaaS pricing model customers will pay $40 per year forever and get everything offered –access to software or hardware, plus support, new functionality, maintenance, servicing, and upgrades.

With perpetual pricing the software business charges $100 in the first year, which means with SaaS they’ll give up $60 in revenue that first year (plus the $20 per year for maintenance and support) and it will take 5 years to break even* and make the $200 ($100 purchase plus 5x$20/year). However, every year after that –for the sixth year, seventh year, eighth year, and so on they’ll make more from each client – (in this case $20 more each year based on a $40 subscription vs the $20 maintenance payment under the purchase model).

Tip: *The breakeven point is the point when a subscription pricing model begins to bring in more money than the perpetual pricing model.

Subscription revenue has the added advantage of remaining stable and predictable without having to sell new units, which means financials won’t be erratic from year to year based solely on new unit sales and how well the organization’s sales team does. This “sell once” financial stability is a huge draw for many.

The benefits go beyond stable cash flow, though. From an accounting perspective, a subscription pricing model has huge value, especially regarding revenue recognition. Since revenues are recognized when realized and earned, not necessarily when received, it’s critical to look at how a move to subscription pricing could potentially change the valuation of a company. The move can also change how and when the company reports revenue; consider the impact to revenue recognition with a subscription pricing model compared to a perpetual model and you can see the potential for change to accounting practices within the company. Some B2B companies find that a move to subscription pricing has positive benefits in these areas, while for others the move may be too complex for the company’s existing structure.

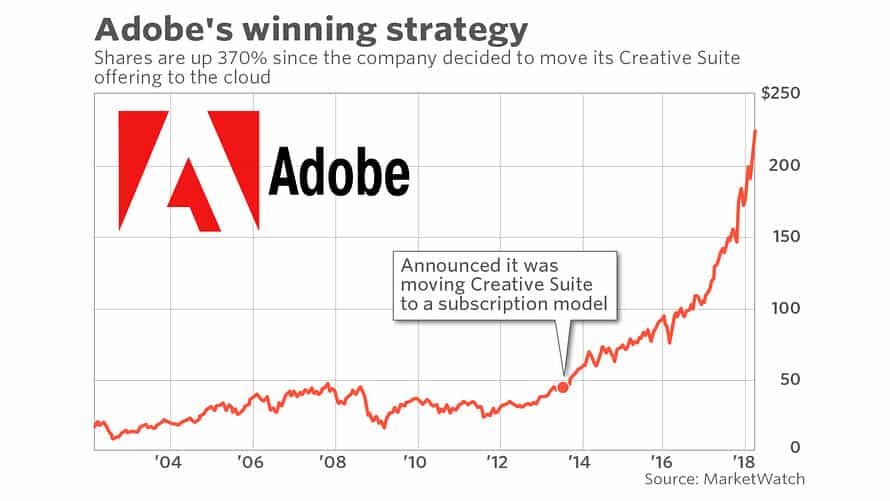

Example: Adobe market share after moving to a subscription model. Source: MarketWatch

The institutional knowledge and revenue mix of current pricing models versus challenging that mode with subscription pricing often come down to a business decision about risk tolerance. Is a company willing to absorb the negative revenue and cash impact in the short term for the long-term benefit? Some companies are comfortable doing this, others are not.

Other Benefits of Subscription Pricing

For most businesses, subscription pricing is one of the best ways to build a recurring revenue stream but there are other benefits.

Subscription pricing is often associated with lower operating expenses. If a company has cash on hand (or a strong cash flow) then it’ll be in a better position to weather the first few years where it’s making less. Once the business hits its break-even point, it’ll be in a much stronger position.

There’s a potential for greater profits over time with subscription pricing, too. In a legacy model, a B2B company might sell one million dollars worth of licenses in year one, but with a subscription system, although it’ll make less than one million dollars in year one, the company will get paid again year after year for each subscription.

For the IT industry, SaaS companies can often add functionality and upgrades without going through the long and painful process of implementation, which makes meeting client needs easier, faster and more performance-centered.

Another reason for businesses to move to subscription pricing is the breadth of customer usage and behavior data available for capture. Knowing your customer better also means knowing their mindset about your products and subscriptions.

Is Subscription Pricing the Right B2B Model? Some Considerations

-

Migrating Customers

New companies usually don’t need to worry about migrating existing customers from a perpetual pricing model to a subscription structure, which makes subscription pricing a simpler option for new companies to implement.

But what if a B2B business already offers perpetual pricing? We’ve helped companies successfully migrate a segmented customer base from a perpetual pricing model to subscription pricing, while simultaneously making the subscription model the only choice for new customers. This approach has been quite successful.

Read More: Case Study on Segmented Migration of Customer Base and New Customers.

-

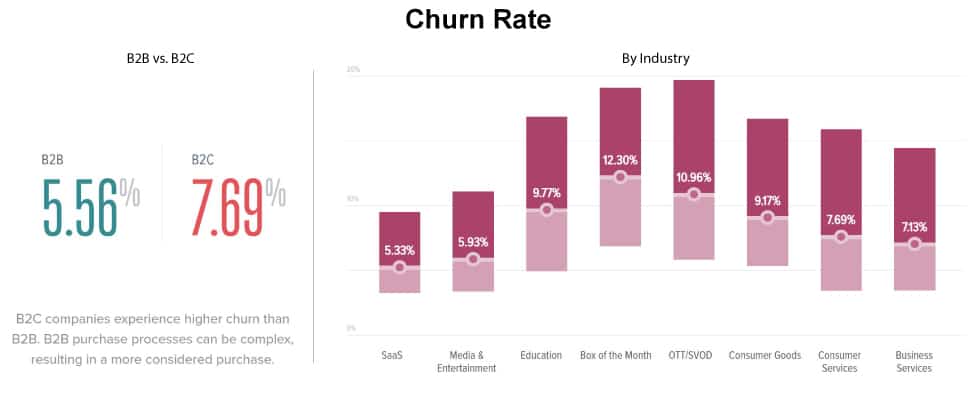

Customer Relationships and Churn

Most businesses are unfamiliar with the dynamic of churn that comes with subscriptions, but it’s critical to factor churn when considering a subscription pricing model. We have seen companies get hung-up over the concern that customers will withdraw from their subscription before they hit the break-even point. It’s important to remember that churn is a function of the value that’s delivered through the product or service. Subscriptions, as with any product or service, must provide value to the customer. They should always be viewed as relationships, and when this relationship provides value for the customer, the impact is significant.

Source: Recurly

-

Customer’s Mindset

How a customer values and uses a product or service is an important consideration when determining whether subscription pricing is the right pricing model for a business and is critical when setting the price and the subscription structure.

Is security important to them? Do customers want automatic updates? Do they want optional upgrades? Instant access to new features? To create the right value proposition for these types of questions companies need to segment customers. For example, a B2B’s small business clientele will have different needs than larger companies.

Building the Offer Structure

Aligning the price metric with value is crucial. To determine value, consider what’s important to your customers – that might be:

- Pay per use

- Performance

- Simplicity

- Accessing content

- Getting personalized services that are customized to their needs

- The ability to change their subscription as their needs change

- Having behind-the-scenes access to new features.

Keep in mind that people who prefer subscription pricing don’t want to pay for things they don’t need, so value really comes down to meeting the needs of customers. If only 20 percent of a company’s services are used by most customers (think of Microsoft’s large suite of software programs), then most won’t want to pay for a subscription that provides access to everything.

Instead, create a subscription structure where customers can choose the services they’d like to use or can choose from a selection of pre-packaged options that offer different levels of services for different prices. We call these trade-off decision criteria ‘Gives and Gets’. Cell phone plans are a familiar example – they allow consumers to choose the package that has the amount of data, long-distance, and other features that best meet their usage at different subscription rates.

To design subscription packages that offer the right services at the right prices to similar customer segments, companies really need to understand what’s valuable to customers as well as their behavior (how they use the product or service) and then align price metrics accordingly.

Market research with interviews or quantitative studies of customer groups along with analysis of historical usage and billing data identifies the needs of each customer segment and key inputs to design subscription structures that will meet those needs.

Crunch the Numbers

Ultimately, the only way to determine whether subscription pricing is a good pricing model for a B2B company is to calculate the break-even and consider whether cash on hand will get the business to that break-even moment and produce a more optimal price realization.

To do this, B2B companies must consider the up-front costs and what they will charge per year. How many years will it take to get to the break-even point (when up-front costs are covered, and the company is making a return on investment)? At what trigger point, if any, should the move be made to subscription only?

The break-even point is a numerical calculation, but there is a strategic decision involved as well. A balance between what’s good for the business and what’s good for the customer; this is especially true if migrating customers from a purchase/pricing model to a subscription pricing model (there must be an incentive for them to move over). In addition to determining the pricing of goods or services, there is a need to carefully determine the subscription structure (new segmentation strategy, customer lifetime value, data capture, usage metrics, is there a commitment for the subscription, are there early cancellation fees, etc…).

While break-even is a key consideration, sometimes it’s not the driving force behind a move. Sometimes the competition forces the transition to subscription pricing. If customers truly prefer the flexibility and benefits offered by subscription models and you’re not able to offer them these perks, then your competition will fill that need instead.

Only when you’ve considered all these factors are you are ready to conduct financial modeling to see the impact on the business that’s created by this pricing change.

Planning and Strategy Key to Successful Subscription Pricing

For most companies, a big revenue dip will cause CFOs who want the benefits of subscription pricing to take pause. To move forward with subscription pricing, a business needs a way to manage the change. To do this it’ll need to first assign a price to each subscription structure and model the pricing to see the effect of the change on the business performance.

B2B companies also need to understand and be ready to capture, analyze and adjust for new buying behavior and purchasing environment.

Ultimately the goal with subscription pricing is to monetize long-term relationships with clients, rather than focus on shipping products; keeping customers on services is critical. When done right, subscription pricing drives recurring monthly revenue and increases customer intimacy. The path to successfully adopting a subscription pricing mindset is simple. Follow these guidelines to make a thoughtful and strategic decision and you’ll ensure a smooth, positive transition for your customers, employees, and stakeholders.

You may be interested in this Case Study: