Conversations about price optimization often involve the demand curve. The point on a demand curve where marginal revenue equals marginal cost is essentially the ‘pricing sweet spot’. Although true from an economic standpoint, very rarely does it capture the “what ifs” of pricing strategy or future changes in customer behavior, both of which have long-term pricing implications.

In the book World Class Pricing: The Journey, we describe pricing optimization as a Level 4 trait in the 5 Levels of World Class Pricing. After businesses have worked through the first three levels – the Firefighter, the Policeman and the Partner respectively – they can start to really tackle pricing optimization, or Level 4 The Scientist.

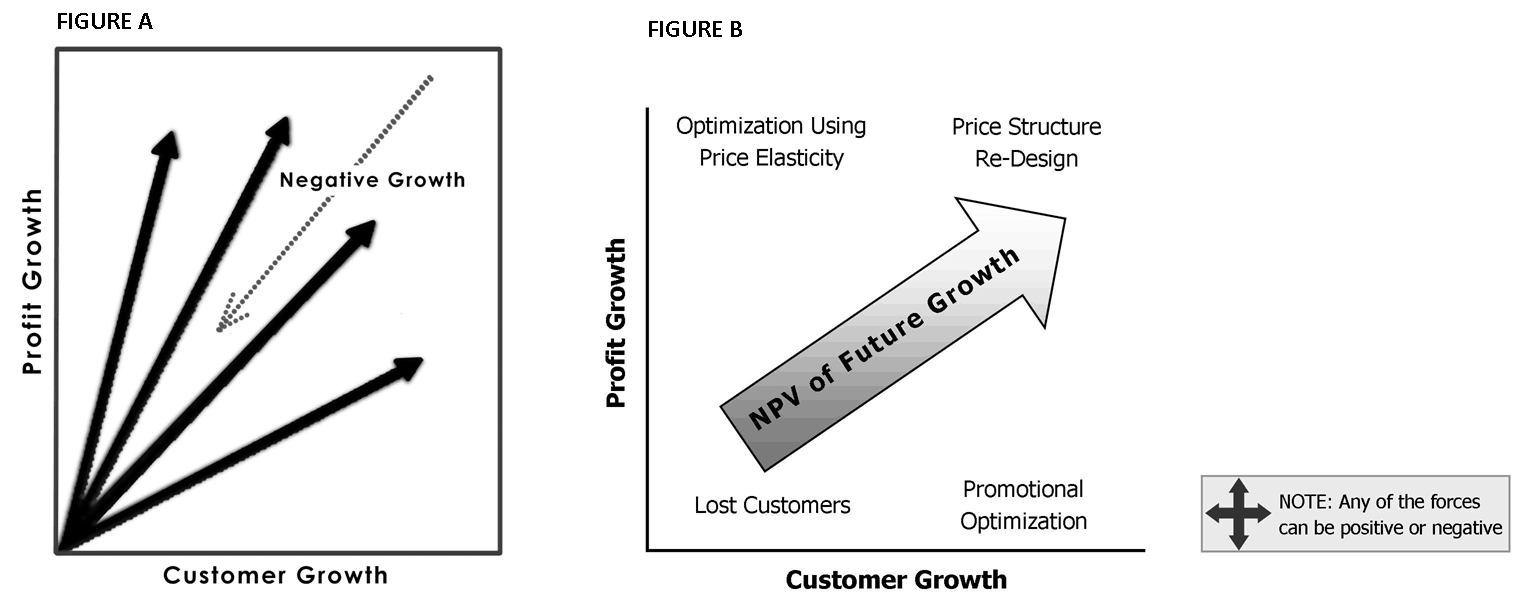

Optimization requires scenario planning. A well-developed scenario planning process ensures your organization is comfortable generating alternatives, modelling the impact, assessing outcomes and selecting a result. For example, there are many different paths businesses can take en route to achieving two key business objectives: maximizing profit and maximizing growth. However, by plotting these objectives on a graph, it looks as if profit can only be achieved at the expense of growth, and vice versa (figure A). But this is not the case…more on this later…

Each arrow in Figure A can be thought of as a different pricing decision. Each trajectory is heavily influenced by pricing management. How does a pricing manager know which pricing strategy to pursue? In World Class Pricing: The Journey, we describe three approaches to optimization:

Price Increases or Decreases

In this approach price increases or decreases are leveraged to achieve price optimization of the everyday business. Pricing managers can successfully implement a price increase (or decrease) by first improving their understanding of price elasticity. Pricing mangers can use conjoint research or transactional data to optimize profit and expected volume without changing the overall pricing structure. Conjoint research also provides insight into the cross-elasticities of products in a portfolio.

Promotions

Our second approach optimizes the use of promotions for overall growth and profit. Both financial and perceptual implications should be considered in the case of promotions. Research can provide insight into expected profit improvements as well as possible changes in customer expectations. For example, will customers expect promotions to become common practice as a result? Pricing managers should have means of predicting these consequences, as well as competitive reaction, as both have implications for long-term pricing success.

Changes to Pricing Structure

It is now, through changes to the pricing structure, that organizations have the opportunity to improve both profit and growth. Pricing fences and customer segmentation play a large part in making this an effective approach to optimization. Not only do they strengthen and broaden relationships with existing clients, but also draw in new, profitable customers.

Let’s look at the Profit Growth/Customer Growth graph again (figure B). Here, the net present value of future growth is impacted, whether positively or negatively, by each trajectory. An effective pricing strategy therefore takes into consideration all three paths, understanding their future impacts beyond quarterly, even yearly target, and capturing as much of the margin generated from a customer segment as possible over the product lifecycle.

Paul Hunt is the president of Pricing Solutions, an international pricing strategy consultancy dedicated to helping clients achieve world-class pricing competency. Paul occasionally publishes a pricing column in the FP Executive. He also writes for the Pricing Solutions Club.