With wide-scale vaccine rollouts well underway, our entry into a post-pandemic world is already a reality for some, and inevitable for others. That’s good news for experience economy survivors —those in the airline, hotel, and travel industries, live events, conferences and trade shows, indoor and outdoor venues, etc. However, reopening raises significant questions around pricing as businesses and consumers brace for our new reality.

The pandemic has increased operating costs (labour, cleaning protocols, testing, tracking, etc.,). With reduced capacity, there are limited opportunities to change pricing. It’s critical, then to capitalize on strong pricing strategies now that can maximize profits and propel those in an experience-related industry forward, as they look to overcome unprecedented pandemic-related losses and establish a new normal.

Pent Up Consumer Demand Will Lead to Inflation

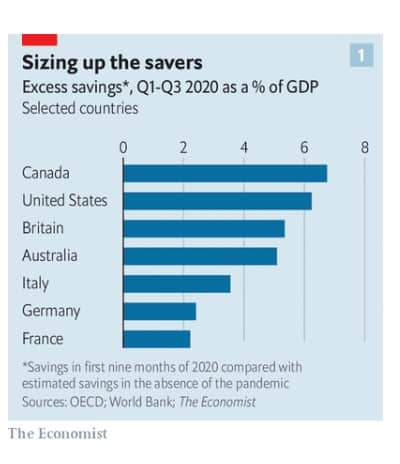

A combination of consumer demand and strict operating protocols will require thoughtful pricing that considers short and long-term strategies. An article in The Economist recently examined pent up consumer demand, comparing it to the consumer-led post-war boom. According to the author, consumers across 21 countries saved six trillion dollars in the first nine months of 2020, with “excess savings of $3trn – a tenth of annual consumer spending in those countries.”

Source: The world’s consumers are sitting on piles of cash. Will they spend it? The Economist. March 13, 2021. Available online: https://www.economist.com/finance-and-economics/2021/03/09/the-worlds-consumers-are-sitting-on-piles-of-cash-will-they-spend-it

Consumers are eager to get out, travel, and experience the world again, and some certainly have the funds to do so. Pent-up demand, money on hand, and constrained supply will undoubtedly lead to inflation. With this low supply, high-demand scenario, expect premium pricing across the experience economy this summer and into 2022.

Widespread price increases have already taken hold of the industry. “As demand for these services soars, companies that once had to compete for customers are now dealing with an overabundance of them,” Kevin Roose writes in The New York Times article Farewell, Millennial Lifestyle Subsidy. “Uber and Lyft have been struggling with a driver shortage, and Airbnb rates reflect surging demand for summer getaways and a shortage of available listings.”

According to Roose, companies like Uber can no longer afford to heavily subsidize their prices, forcing significant price increases. The average Uber and Lyft ride has increased by 40 percent compared to a year ago, and the average daily rate of an Airbnb rental increased “35 percent in the first quarter of 2021, compared with the same quarter the year before,” he says.

Higher Willingness-to-Pay Depends on Consumer Confidence

Customers have the funds and are itching to catch up on lost time with memorable experiences, but psychology around safety will play a role in how confident people feel in traveling, attending live events, and mingling in crowds once again. Communicating the quality and safety standards that are in place will be essential – from enhanced cleaning protocols to increased ventilation to capacity restrictions for events.

There are digital solutions in place to monitor infection control in hospitals and health care settings that could be applied in facilities like casinos, hotels, or museums. In addition to innovative technology, other creative solutions may take the form of incentives for consumers who are vaccinated or who undergo testing prior to an event.

One of the key takeaways is recognizing that quality and safety standards must become part of a company’s value proposition to gain consumer confidence and encourage a return. MGM Resorts, for example, has digital innovations in place alongside enhanced sanitation, HVAC, and air quality controls, and revised policies, training, and response protocols.

Yearning for Experiences Creates Strong Pricing Power

A supply-constrained world breeds strong pricing power. One way to harness this environment is with pricing around VIP access. Disney is notorious for incorporating VIP access in its pricing. Even with capacity constraints, they can take advantage of constrained supply to make up in pricing for the approximately 2.6 billion in losses suffered while closed.

Although reduced capacity restrictions may make it difficult for amusement parks to charge to bypass lines, there are other ways they and other venues can use pricing power to maximize revenue. Take Montreal’s Morgan Arboretum, for example. During the pandemic, demand to visit the Arboretum increased considerably, so much so that staff were not able to take on new members. Going forward, existing members have priority to renew their memberships, whilst new applicants must wait in queue to join.

With reduced capacity, meeting demand has been challenging for some venues. However, these hurdles can be turned into opportunities (extending hours to allow more visitors through, for example). It’s important to keep pricing power in mind upon reopening and have the pricing confidence to:

- Raise ticket prices

- Offer premier perks, membership benefits, or VIP passes (like access to special events)

- Charge a premium for:

- Booking access to preferred time slots

- Longer stays or access to extended hours

- VIP parking

- Blockbuster or highly anticipated events

- Access to restricted areas

- Cancellation policies (consider tiered pricing for certain timing milestones as seen with airline tickets)

- Implement strategic promotions. One strategy is to raise prices and then offer a promotion off this higher price to capture price-sensitive consumers.

- Charge more for spontaneity:

-

- Spur-of-the-moment bookings will likely take a backseat to pre-planning as consumers have to book time slots to enjoy live events.

- Consumers will have a higher WTP for the flexibility of last-minute planning.

- Expect dynamic ticket pricing structures that correlate to the number of tickets sold for concerts, live theatre, and sporting events to continue.

Indoor Versus Outdoor – Where Does the Pricing Power Lie?

Considering that many consumers have been cooped up inside, outdoor activities and events will have an edge over indoor venues, especially considering the reduced capacity and higher safety measures needed indoors. Golf, patio dining, camp-grounds, and other outdoor experiences may prove more popular this summer as people with concerns about being indoors look for ways to socialize safely outside. These venues should be sure to capitalize on their pricing power as most patrons will have a higher willingness-to-pay (WTP).

It will be important to continue to innovate. Some traditionally indoor events will move outdoors this summer, but with the world reopening we expect many pandemic offerings (like streamed live concerts) to continue. Take zoos, for example. Many had to find creative ways to stay open during the pandemic and offered drive-through visits, which they could continue post-pandemic to capitalize on bad weather days or even to provide winter-access to certain animals.

Predict and Price for Consumer Behaviour

Pricing Solutions has worked closely with major players within the experience economy to identify and predict consumer behaviour around where to stay; purchasing day, multi-day, or weekly passes; meal plans; extended access to nearby venues, etc.

Understanding how consumers think around all these decision points, and the trade-offs they make will help those in the experience economy make informed pricing decisions. For example, knowing whether consumers will compromise on a lower-tier hotel to maximize the number of days in their stay can lead to a myriad of value-based pricing strategies.

The role of understanding and segmenting consumers based on their behaviour will continue to be critical. For example, will families and millennials deprived of experiences during the pandemic cause a huge resurgence in the experience economy while older adults who are more at risk remain cautious or have a lower WTP?

It’s also important to consider how a give/gets approach to pricing will impact the bottom line. For example, discounting longer stays or lower prices for customers who sign up for a yearly service instead of making a one-off purchase. Canada’s Wonderland most notably did this when they extended the validity of this year’s season pass into next year, making it valid until September 2022.

Identify Value Drivers

Understanding consumer behaviour is important, but it’s also necessary to consider which of the changes witnessed during the pandemic will remain permanently. For example, people are more attuned to consume in a digital fashion and that is not likely to change. Focus on identifying these value drivers and price accordingly.

Parking is a huge value driver that’s not very well understood. Charging a premium on parking and offering better parking to members is incredibly valuable, especially for families with young children who subsequently have a lot to carry for a day trip.

It’s also important for those in the experience economy to really think about how the world is changing and model pricing around that. For example, consider offering EV charging stations to attract a new subset of customers. There’s been a green movement of late as consumers shift to more ecological choices – EV vehicles are likely to stay but will the popularity of outdoor-immersive experiences (like camping and RVing) remain popular in the years to come?

Those within the experience economy who establish strong pricing strategies by capitalizing on their pricing power, gaining consumer confidence, considering consumer behaviour, and identifying value drivers will maximize profits, overcome pandemic-related losses, and set the groundwork for long-term success. One thing is for sure – there’s no time to lose. Contact the team at Pricing Solutions to make the most of peak consumer demand this summer.