By Paul Hunt, Chairman at Pricing Solutions

The 80 /20 business model is not just about squeezing out the complex customers/product lines that only makeup 20% of your revenue. It is also about extracting more value out of those who make up the critical 80% with value-based pricing strategies.

A Layered and Streamlined Approach to Pricing

Is there such a thing as selling too many products or having too many customers? The resounding answer is ‘yes’! Many successful industrial manufacturing companies have proven it by using the 80/20 process developed and refined at Illinois Tool Works.

80/20 is a proven methodology for reducing complexity, which decreases costs and dramatically improves profits, but there is one area that 80/20 does not do a great job of addressing and that is pricing. For this reason, pricing is a major opportunity for companies using the 80/20 process to increase revenue and price effectiveness.

First, let’s briefly review what the 80/20 process is and how it works.

80/20 is a process of sorting products and customers into two categories: those in the “80” category comprise 80 percent of the company’s revenue. Those in the “20” category include the remaining 20 percent of the company’s revenue.

Companies use transaction data to segment customers and products into two groups based on their revenue contribution.

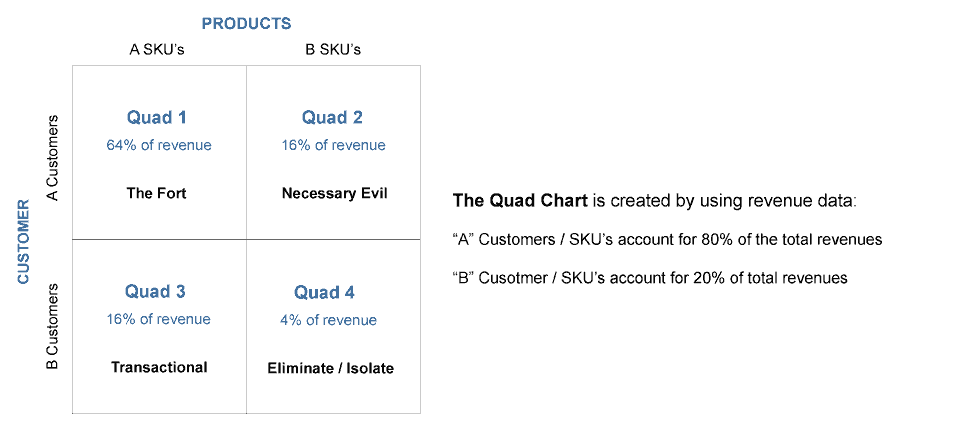

The following chart is a nice way to organize customers and products for the 80/20 model. “A” Customers/SKUs are those that account for 80 percent of the revenue. “B” Customers/SKUs account for 20 percent of the revenue (hence the name 80/20).

Companies can place their individual customers, SKUs, and services on this chart or use hierarchies and families as an alternative.

Basic Pricing Principles of 80/20

There are a few simple pricing moves prescribed by 80/20. The most basic of them is to dramatically increase the price in quadrants three and four, which results in significant price increases for 20’s customers.

Many businesses that are using the 80/20 model are deathly afraid of raising prices for their 80’s customers. In fact, the focus is on overserving 80’s customers because that is where the least complexity and biggest growth opportunities are.

However, price increases aren’t the only pricing strategy for companies using the 80/20 process. Our team has developed a layered approach to the 80/20 model that drives significant profit improvement. The price effectiveness improvement results seen are typically an average of two percent of earnings before interest, taxes, and amortization (EBITA) in addition to the more traditional cost savings that come from the 80/20 process.

The Layering Process and Segmentation for 80/20 Pricing

Businesses using the 80/20 model have already organized clients into an 80 or 20 category based on internal data and analyses. However, further refinement by layering pricing segmentation overtop of the 80/20 model is critical to optimize outcomes and reduce pricing leaks.

By having a margin driven cross-section of customers and products, clearer picture forms of which products or customers need specific pricing actions.

From a cost and complexity perspective, the abovementioned four-quadrant chart is still an effective way to organize customers for the 80/20 model. To create a different view for pricing, we use margin and discount data, placing customers, SKUs, and services into the quads to create a new layer or view of the four-quadrant chart.

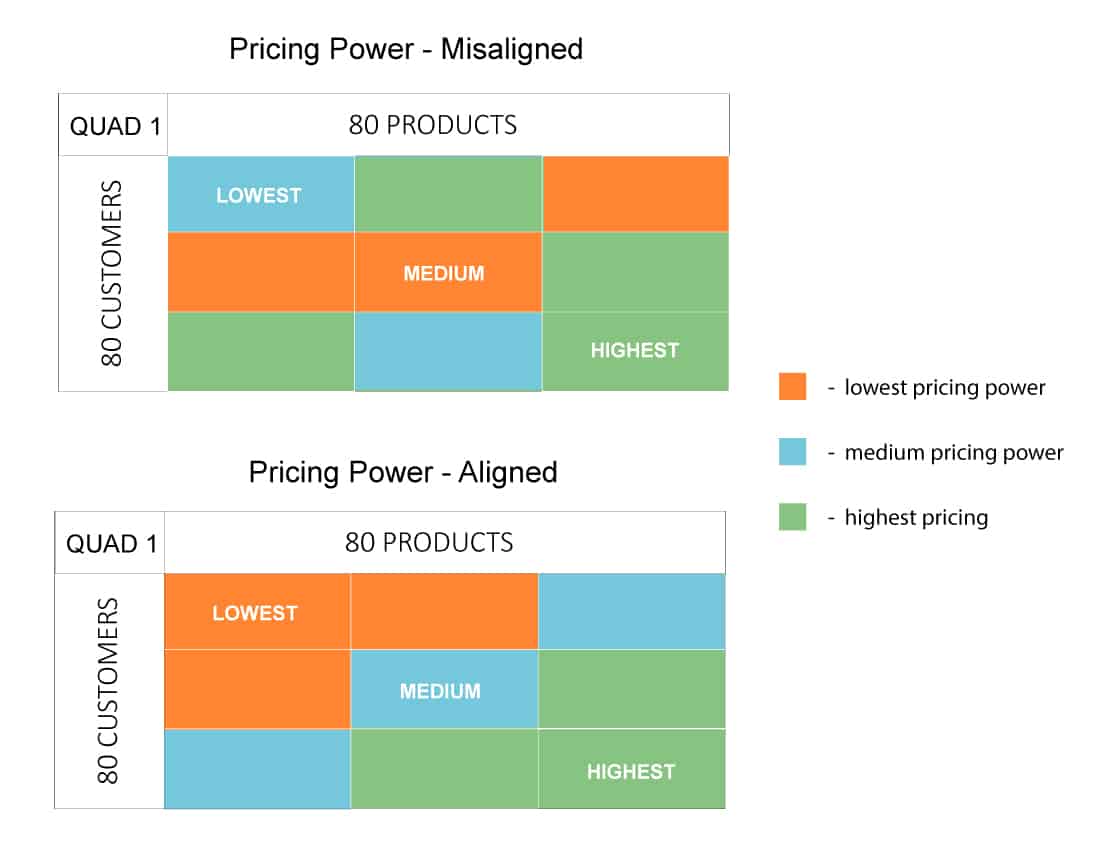

After organizing customers and products into each of the four quadrants, the next step is to focus on the first quadrant and further segment to make better, more targeted pricing strategies. To do this, a company can apply a scoring system to reveal how the current customer base or product portfolio scores within each quadrant.

Scoring refers to the product’s pricing power. Not every 80’s product in a company’s portfolio will have the same pricing power, but when you segment the products by pricing power within a quadrant you can uncover increased margin opportunities.

A useful tactic to consider at this stage is to run the 80/20 pricing analysis separating those products sold directly to customers or to OEMs from those sold through distributors. Often it also helps to separate parts from original equipment.

When a company has thousands of products and customers the potential to save money in terms of cost, and explore untapped opportunities to make more money by pricing for value is very powerful.

To identify pricing inconsistencies within each quadrant, a business must:

- Interview customers and internal stakeholders

- Conduct an analysis of pricing data

- Work with the company’s 80/20 stakeholders.

To better understand pricing opportunities, ask these questions:

- What prices are quoted to customers for these products?

- Are these customers offered an incentive program?

- What is the value and pricing power by product and customer?

- What is the net margin or discount alignment?

Note: Criteria that you use for scoring should ideally be in your data. For example, some of the criteria we have used for Products include revenue, growth and total price. But there can be several more depending upon your data.

Once a layered and segmented pricing approach has been successfully implemented in the first quadrant, the business can then move onto the second quadrant and refine strategies through segmentation. Then to the third and fourth quadrants.

Identify and Correct Inconsistencies

Through our analysis of 80/20 businesses, we have found that customers in quadrant one often receive essentially the same discount as those in quadrant three. For one of our clients, that the difference between customers in the 80 and 20 categories was one percent. We would expect the difference to be more like 30 to 40 percent. This inconsistency meant that the company was leaving 29 to 39 percent margin on the table across all four quadrants.

Other common inconsistencies are often found around net margins and list price. A layered approach to pricing in the 80/20 model also helps businesses identify areas where their current pricing practices are faulty.

When it comes to shifting a company’s core pricing strategies, our four most common suggestions include:

- Stop applying discounts or price increases across the board. Instead, focus on the margin each quadrant can generate. This strategy will yield the best margin on each individual product.

- Let go of past decisions. Offering legacy products, or discounts based on volume or relationship will not increase margins. Only offer discounts where it makes sense to, based on the quadrant analysis.

- Examine freight, shipping and distribution practices for leakages and reconsider taking pricing actions around these services.

- Reconsider the pricing of innovative products. If you price the new product based on legacy pricing then the new product will often fail to yield a significantly better return on sales (ROS). Instead, use the 80/20 score and segmentation analysis to set pricing and capture target margins.

Correcting these pricing inconsistencies will increase margins significantly. Overall, our clients find an average of two to four percent increased profitability by overlaying a segmented pricing strategy to their traditional 80/20 strategy. An annual review of the 80/20 strategy and continuous refinement further reduces internal costs and supports strategic price increases. Importantly, investors see these price actions as sustainable and equal to creating long-term value through price effectiveness.

Train Your Team on Pricing

Pricing Solutions offers valuable support to companies looking to successfully implement this 80/20 process. Many companies have complex pricing environments and find it difficult to properly categorize products and customers into the 80/20 model, conduct accurate segmentation, or make refinements. Our experts train pricing and sales teams to not only change company culture, but also to independently conduct these analyses on an annual basis, or with our team’s support where needed.

Refining the 80/20 pricing model year after year with a layered approach provides a better return on investment and moves a firm away from legacy pricing practices or basic cost reductions to improve performance.

Looking to refine your 80/20 process?Contact our team for specialist pricing advice to maximize profits and pricing efficiency within your organization.