500MM

in Estimated Sales

The Challenge

The company did not have a strong understanding of new product pricing, and the drug would be the first indicated treatment for a rare condition. The pharma company had concerns it would not capture optimal revenue. It lacked a robust pricing strategy. Further complicating matters, drug payers had been exposed to very high launch prices but had mechanisms to limit prescribing. It also was not uncommon to face media backlash in the US market due to pricing.

Pharmaceuticals and Biotech Industries

Without a strong understanding of current market conditions and key value drivers, pharmaceutical companies struggle to set optimal launch prices. However, sales expectations are higher than ever for new drugs. Poor launch performance signals long-term challenges that can prove extremely difficult to overcome.

So while in the process of preparing for the release of a new orphan drug in the US market, one pharmaceutical company appointed Pricing Solutions to help them execute a confident go to-market strategy. The pharma company, among the world’s 50 largest, estimated sales for the drug would peak at approximately $500 million though it believed its orphan drug brought much more value to the market.

Pharmaceuticals Pricing Case Study

Building a Solution that Fits

Pricing Solutions would need to conduct a full 3600 launch price evaluation of the major orphan product. That meant starting with a thorough research study. Multiple rounds of interviews would be essential:

- First, internal interviews with senior managers from the pharmaceutical company’s Sales, Marketing and Commercial teams were scheduled

- In-depth interviews were done with key payer groups from commercial, Medicare and Medicaid plans

- A quantitative study with specialists was needed

- Finally, in-depth interviews with key opinion leaders – those with extensive experience and knowledge of the rare disease – would be held

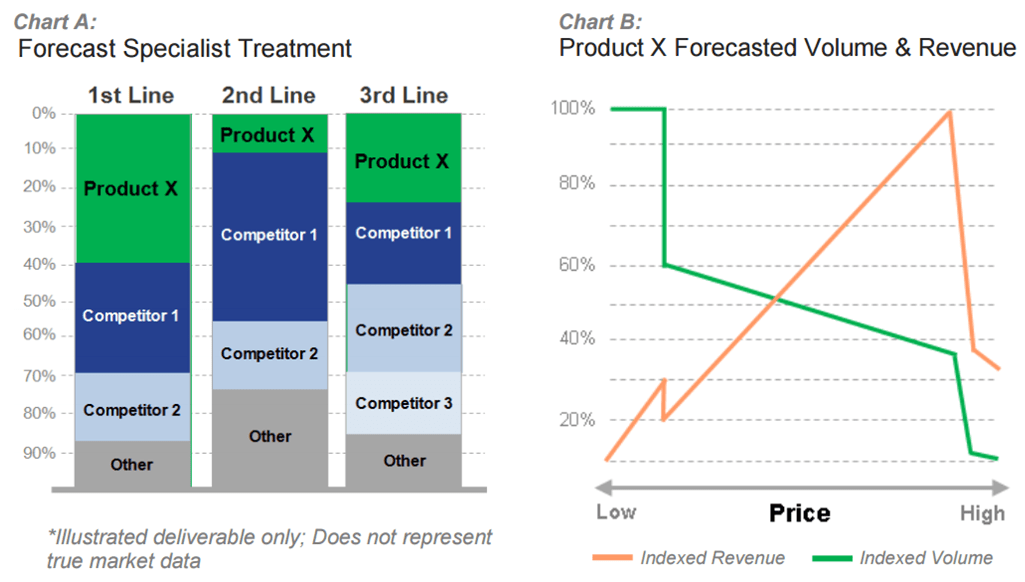

These gave Pricing Solutions an understanding of the importance of clinical and commercial factors in the payers’ decision-making process around coverage. The acceptability of different price points and price structures were tested in order to establish the key psychological thresholds. Insight from Specialists were captured from a larger sample to understand the prescribing price sensitivity on a practice level. This data was used to estimate expected volume usage levels, taking into account dosing, compliance and persistence. The research was able to confidently forecast prescribing of the drug, allowing for restrictions imposed by payers (see Chart A).

By testing a number of price points, it was possible to evaluate how physician prescribing and payer restrictions changed as price increased. This served as the basis for Pricing Solutions’ calculation of a price volume chart. (see Chart B).

The final step in Pricing Solutions’ 3600 assessment would combine the existing wisdom of the client’s project team and senior stakeholders with Pricing Solutions data analysis. Pricing Solutions met with the client to present and discuss strategic options. Pricing Solutions presented each in terms of revenue, risk volume, company reputation and logistics impact so the most comprehensive go-to-market strategy could be employed.

The Result?

The pharmaceutical company’s product team was now in a position to make strategic and tactical pricing decisions with confidence. Pricing Solutions prioritized six recommendations to implement during launch, and identified the price that returned optimal revenue in the current market (see Chart B). Today, the product has successfully launched under the prices recommended by Pricing Solutions.

The Pricing Solutions Difference

Pricing Solutions has in-depth knowledge of healthcare launch pricing in major global markets. Our experience across 700+ pricing research and modelling projects instills client confidence in our recommendations. We leverage our full healthcare expertise, and model of Pricing Research through the 5 Critical Stages of the Product Lifecycle, to deliver solutions for both established and alternative business models.