Last year we asked the question Can You Protect Your Business and Clients from Cost Shocks? While we may have all hoped that the surge in the cost of raw materials and Pandemic-related disruptions would dissipate, the truth is that we’re now in a significant period of inflation with most companies needing to increase prices in the high single digits or low double digits just to stay neutral. Considering that the 1970s was the last time we saw a sustained period of inflation, this scenario is new for most of us and creates additional challenges for anyone operating in the world of pricing. Instead of simply looking at typical “across the board” price increases for 2022, consider these three strategies to reduce customer resistance to a large price increase: Pricing’s Power of 1%, cost-to-serve, and value-based pricing.

Lean on the Pricing’s Power of 1%

Can you use pricing to make your business more profitable? If you know our work, then you’ll be familiar with the Power of 1%. Gaining 1% of the price by looking at different customers by the revenue contributed and the actual gross margin generated of each almost always leads to tremendous gains. For example, the Pricing Solutions team recently helped one of our customers generate 4% gross margin improvement by narrowing the use of discounting by customer profile without losing deals. Through customer micro-segmentation that identifies similar customers showing similar buying behavior. Establishing a logical price structure based on margin across customers and products is critical. We have customers for whom this strategy has been extremely successful. Using transaction analysis that reflects revenue and margin between segments has resulted in a 1.5% to 5% EBIDTA improvement in the first year for these customers across industries, reducing the size of more general prices increases.

Identify the True Cost to Serve

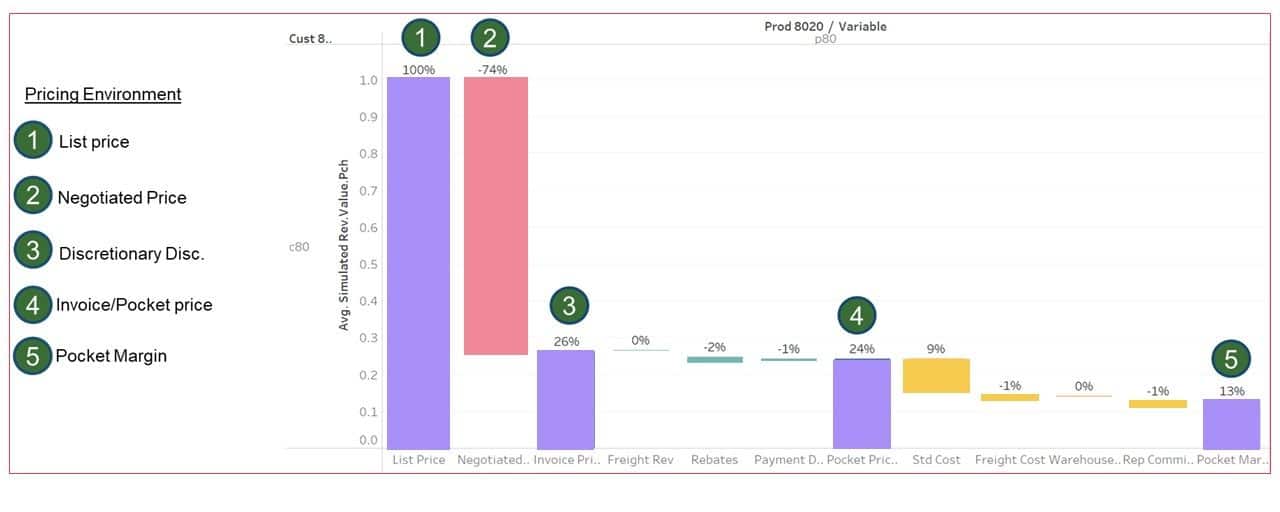

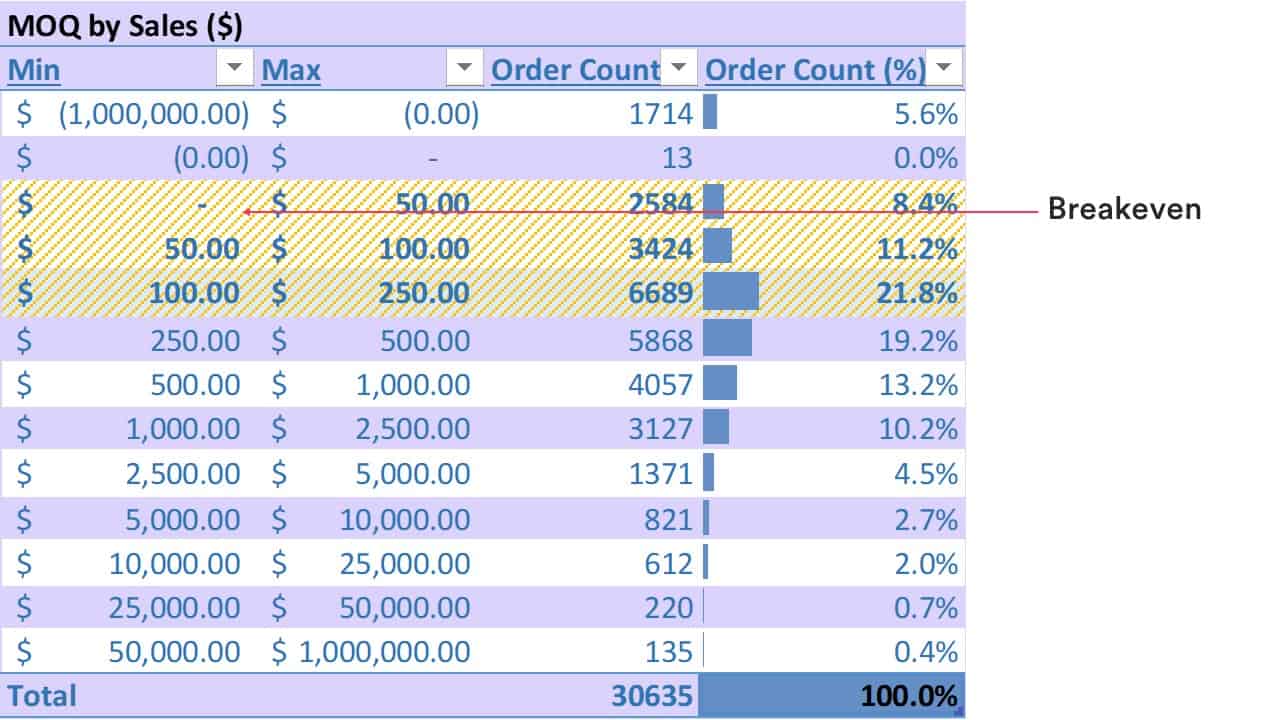

Here’s how our team helped recover $10 million by reducing our client’s cost-to-serve. The key areas we look at today are differences in order frequency, minimum order quantities, freight policies, and order fulfillment. Administration of invoices, pick/pack and shipping on orders below $250 are all likely unprofitable. In some industries that breakeven figure is higher. A price waterfall analysis can help you to identify other pricing leakages (areas where you’re losing money as part of your cost to serve) if it is a bottoms-up analysis. This analysis should include a look at individual transactions fulfillment by order that includes the walk from list price, invoice price, net price, and down to pocket margin. You can almost always find ways to lower your cost to serve instead of cutting budgets with the added benefit of changing behavior to lower complexity costs and better servicing key customers. Doing so will allow you to achieve the same profitability as a small price change. In today’s market conditions, this may also be an easier place to start such that any price moves are not lost to margin leakages.

Consider order behavior. Explore differences between contracts, orders, and the number of invoices tied to fulfillment and you may find significant variances. Many businesses discover there is a very high percentage of small orders that go unnoticed. When you reveal the true cost to serve each customer, you’ll uncover opportunities where you can implement targeted changes to pricing. Consider building a playbook of trade-offs and a give/gets strategy rooted in value-based pricing to negotiate new surcharges, fees or policies around the following areas.

Value-Based Pricing: Not All Customers Are Created Equal

Businesses typically avoid turning away customers and product ideas, which can lead to supporting customers and products that often drain more resources than the return. As a result, most companies have different levels of profitability with each customer. These differences in the contribution when put against buying behavior similarities and revenue, provide transparency into value. For the purposes of pricing, it’s important to segment customers based on profitability drivers rather than size and then implement value-based premium pricing accordingly. Here are some areas to look at:

- Clusters of customers buying similar products

- Order behaviour including size, frequency, and speed of the order (lead time is important here – urgent orders will reduce your profit margins).

- Expedited orders that include material and production factors to fulfill

- Change orders where a customer changes the mix, size or delivery of an existing order

- Delivery, freight, and shipment costs

- Shipment size

- Inventory costs

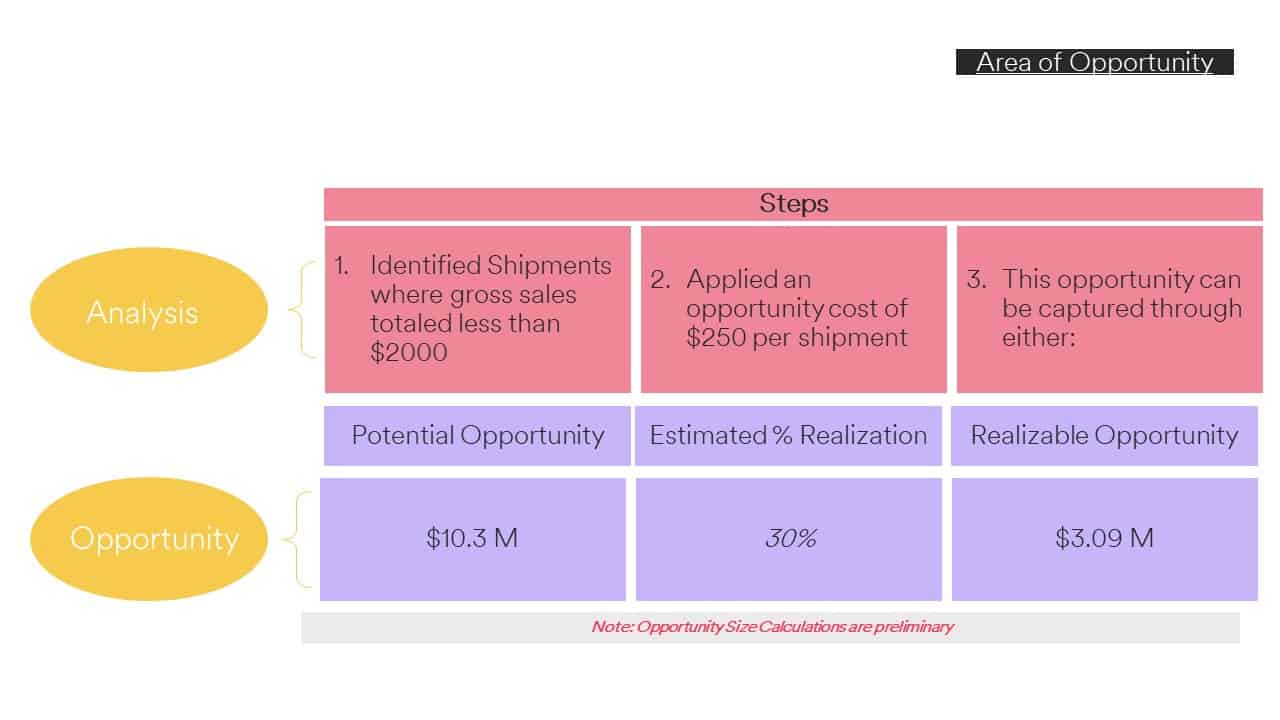

Also, look for areas of opportunity to increase profitability. Let’s take minimum shipment size as an example. Identify customers whose shipments result in gross sales that total less than $2,000. Then, apply an opportunity cost of $250 per shipment to increase your profit margin.

Charge for the Value You’re Providing Customers

Using a value-based pricing approach will help you reconsider your true cost to serve each customer. You may also identify opportunities in which you can charge a premium price, especially where elements of your product and service offerings are highly differentiated. Customers want the best value, not just the best price – keep that in mind when you examine the value that your service offerings bring to customers. Reward those customers who create efficiency in your operations and capture a little more from those that don’t.

Looking forward to 2022, when it comes to pricing in an era of inflation it will be critical to update your pricing practices and logic. The times of releasing an annual printed price book are over. If you haven’t yet, consider the move to digital because the more digital you are, the more equipped you are to implement dynamic pricing changes, which is a game-changer, especially now during a time of sustained inflation. Learn more: Digital Pricing Transformations