Ed Heskins, Pricing Consultant at Pricing Solutions

“A bargain ain’t a bargain unless it’s something you need.” – Sidney Carroll

On Friday, UK retailers kick-started a £10bn shopping extravaganza, thereby marking the unofficial start of the Christmas shopping season. Over the last 10 years, “Black Friday” – a US tradition conceived as a post-Thanksgiving stimulus for weary shoppers – has grown from a relative sideshow in the UK to one of the most eagerly anticipated shopping days of the year.

Changing Trends in the UK Retail Environment

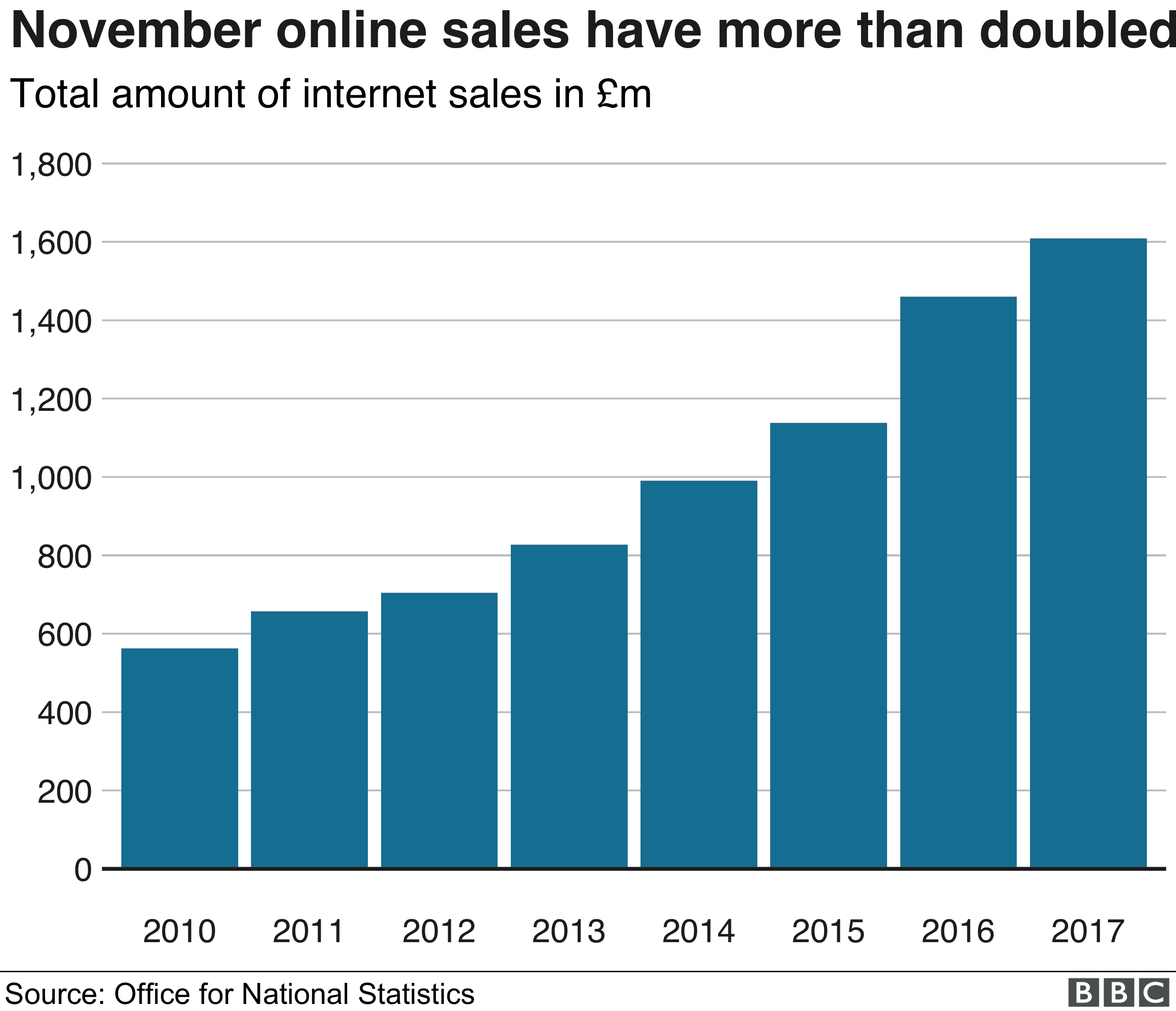

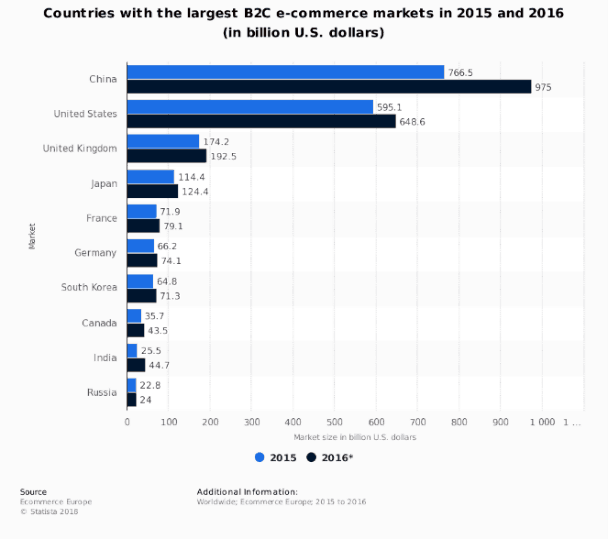

Fuelling this growth has been the expansion of online shopping (see chart 1), a trend for which the UK represents the 3rd largest market globally, behind China and USA but ahead of other major European markets including France and Germany (chart 2). The importance of online retailing, both abroad and in the UK, has led retailers to dub today “Cyber Monday” (originally, “Black Friday” for online shopping), a day dominated by online discounting and promotional activity.

Chart 1: UK Internet Sales over years. Source: BBC News.

Chart 2: Countries with the largest B2C e-commerce markets in 2015 and 2016. Source: Statista.

This drive to digital sales channels has had many benefits for UK retailers, who are now able to reach a wider customer base without incurring many of the operational costs associated with bricks-and-mortar businesses, and who can move into new markets and product lines quicker and more cheaply than ever before. However, the benefits of online sales don’t come without some pitfalls. To better understand how UK retailers should address Black Friday and Cyber Monday sales, we are discussing 3 common challenges and tips for avoiding them.

Challenge 1: Price Transparency

Price transparency on online platforms means it is now easier than ever for consumers to do research on historical pricing and find Black Friday or Cyber Monday bargains. Prime comparison website, such as CamelCamelCamel, can track prices for products on Amazon over an extended time period, allowing consumers to separate genuine price reductions from mere salesmanship. Companies that sell through different distribution channels should be especially conscious about this because they can see even the most disciplined pricing strategies in one channel coming under pressure from an uncontrolled strategy and unfair pricing in another. In one example we have seen, a manufacturer investigating declining sales through their own online platform discovered that a retailer they were supplying was undercutting their price by more than 40%!

Solution: Global pricing transparency is a difficult challenge to wrestle to the ground. It not only requires coordination between the regions but most importantly transparency internally. To achieve internal alignment, companies must become more adept at developing pricing strategies that address this challenge.

Read more: Price Transparency is leaving many companies feeling NAKED!

Challenge 2: Price Wars Caused by Algorithmic Price Tracking

Alongside this, the rise of algorithmic price trackers means that the retailers are ever more likely to be sucked into price wars, where the time difference between making a price change and the competitive response can be measured in minutes and seconds, rather than hours or days. Studies into Amazon have suggested that the site favors algorithmic pricing in its search results – even when the price quoted is not the cheapest. According to one researcher, “the idea of all retailers being independent is increasingly sort of quaint. They are all watching each other… it’s not explicitly collusion, but it’s highly correlated”.

Solution: A price war is every retailer’s worst nightmare. While price decrease may improve Q4 store traffic and sales volume, it still can destroy profits. For the average company, a 1% drop in price can slash operating profits by up to 12% – 15%. So how to win in price wars? The simple answer is to avoid it in the first place, not to succumb to provocations created by price trackers, and focus on the delivered value instead.

Read more: How to Avoid a Price War

Challenge 3: Changing Customer Expectations

And there is a slowly growing sense among customers that some of the promotions found on Black Friday may not be as attractive as advertised. A recent study by Which found that many of the products advertised as having huge discounts during Black Friday can be picked up more cheaply at other times of the year, and while Black Friday sales are expecting to grow again this year, there is some evidence that this is slowing.

Solution: Instead of justifying yourself by putting a minimum price on items during Black Friday or Cyber Monday, use holidays as an opportunity to convey additional value to your core customers. For example, Topshop and Burberry did so by giving digital access to clients to buy items straight from the catwalk. This gives customers a sense of getting more for the full price they are paying.

Read more: 4 Strategies to Improve Your Retail Pricing Management

Value is the Key

So what can retailers do to address some of these challenges during Black Friday and Cyber Monday? The answer is to focus on the value delivered to the customer and avoid pure price competition, especially online. Even John Lewis, with their famous “Never knowingly undersold” mantra, recognizes that this comparison can only apply to other bricks-and-mortar retailers, and refuse to challenge the online-only behemoths.

According to Retail Times, others have used Black Friday as an opportunity to launch new products, or to introduce limited promotional discounting to certain product lines, rather than the widespread discounting of previous years. Finally, some retailers – including ASDA, one of the firms originally credited with bringing the tradition to the UK – will choose not to participate in Black Friday at all.

Time will tell whether these retailers will have the courage (and deep enough pockets) to resist being drawn into further price wars. No retailer wants to miss out on a flood of customers being lured in by flashy discounts and eye-catching price cuts, especially to a competitor. But with retailers facing dramatically shrinking margins and consumers becoming ever more equipped to track price changes, offline and on, competing on price alone is no longer an option.